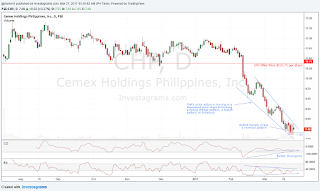

CHP Bullish Divergence pattern

Cemex Holdings Philippines, Inc.

CHP's recent price action is moving in a downward price channel and forming a Falling Wedge pattern, considered a bullish pattern on breakout. The Bullish Divergence pattern on some indicators also suggest an impending consolidation or trend reversal to potentially unfold.

There's also a Bullish Harami Cross candlestick pattern that formed up two trading days ago which is considered a significant bullish reversal pattern on confirmation. If another bullish candlestick pattern shows up to form a price congestion area, it will potentially mark the bottom of the current downtrend.

Trading Plan

- Buy the breakout from the Falling Wedge pattern (only consider this action on breakout confirmation).

- If more bullish reversal candlestick pattern shows up in a sideways price action, consider a test buy for a position trade.

- Always set a stop-loss in either of the trading setup to manage the downside risk (can be a few points from the recent swing low)

CHP's recent price action is moving in a downward price channel and forming a Falling Wedge pattern, considered a bullish pattern on breakout. The Bullish Divergence pattern on some indicators also suggest an impending consolidation or trend reversal to potentially unfold.

There's also a Bullish Harami Cross candlestick pattern that formed up two trading days ago which is considered a significant bullish reversal pattern on confirmation. If another bullish candlestick pattern shows up to form a price congestion area, it will potentially mark the bottom of the current downtrend.

Trading Plan

- Buy the breakout from the Falling Wedge pattern (only consider this action on breakout confirmation).

- If more bullish reversal candlestick pattern shows up in a sideways price action, consider a test buy for a position trade.

- Always set a stop-loss in either of the trading setup to manage the downside risk (can be a few points from the recent swing low)

Comments

Post a Comment